Ensuring Business Continuity Amidst the Pandemic Challenges

Navigating Business Continuity Amidst the Pandemic Challenges

The COVID-19 pandemic has brought unprecedented challenges to businesses worldwide. Ensuring business continuity in the face of such uncertainties has become a top priority. Organizations are adopting strategic measures to adapt, survive, and thrive in this dynamically changing landscape.

Resilience through Remote Work Adoption:

One of the key strategies for business continuity during the pandemic has been the widespread adoption of remote work. Companies quickly transitioned to remote work models, leveraging technology to maintain operations. This shift not only ensured employee safety but also showcased the adaptability of businesses in the face of adversity.

Digital Transformation as a Pillar of Continuity:

Embracing digital transformation has proven to be a critical pillar for business continuity. Companies that invested in technology found themselves better equipped to navigate disruptions. Cloud computing, digital collaboration tools, and e-commerce platforms have played pivotal roles in enabling seamless operations and customer engagement, even in the most challenging times.

Supply Chain Resilience and Diversification:

The pandemic exposed vulnerabilities in global supply chains, prompting businesses to reassess and enhance their supply chain strategies. Building resilience through diversification, local sourcing, and strategic partnerships became essential. This shift aimed to mitigate the impact of disruptions and ensure a steady flow of goods and services.

Financial Planning and Adaptive Budgeting:

Financial stability is fundamental to business continuity. Companies focused on adaptive budgeting, revisiting financial plans, and exploring cost-saving measures. Financial agility allowed businesses to weather the storm, ensuring the availability of resources for essential operations and strategic initiatives.

Crisis Communication and Stakeholder Management:

Effective communication during a crisis is paramount. Businesses prioritized transparent and timely communication with employees, customers, and stakeholders. Managing expectations and demonstrating a commitment to transparency fostered trust and goodwill, essential elements for maintaining business continuity in times of uncertainty.

Business Continuity Pandemic: A Holistic Approach

In the pursuit of business continuity during the pandemic, adopting a holistic approach is imperative. Combining remote work strategies, digital transformation initiatives, supply chain resilience, financial planning, and effective communication creates a comprehensive framework to navigate the challenges posed by the ongoing global crisis.

To explore more insights on Business Continuity during the Pandemic, visit Business Continuity Pandemic for valuable resources and guidance.

Innovation as a Driver of Continuity:

Innovation emerged as a driving force behind business continuity. Companies that embraced innovation found new ways to deliver products and services, often discovering untapped opportunities. Adapting to market shifts and consumer behavior changes became integral to sustaining operations and maintaining relevance.

Employee Well-being and Organizational Culture:

Prioritizing employee well-being and nurturing a resilient organizational culture contributed significantly to business continuity. Companies that invested in supporting their employees’ mental health, providing flexibility, and fostering a sense of belonging witnessed increased productivity and loyalty, further ensuring continuity during challenging times.

Preparing for Future Uncertainties:

As businesses navigate the current challenges, preparing for future uncertainties remains a constant consideration. Scenario planning, risk assessments, and continuous improvement strategies are essential components of building resilience. Proactively addressing potential disruptions positions businesses to respond effectively and ensure continuity in the face of unforeseen challenges.

Conclusion:

Ensuring business continuity during the pandemic requires a multifaceted approach that encompasses remote work, digital transformation, supply chain resilience, financial planning, crisis communication, innovation, employee well-being, and proactive preparation for future uncertainties. By embracing these strategies, businesses can not only survive the current challenges but also thrive in a rapidly changing global landscape.

Adapting Success: Business Strategies Amid the Pandemic

Adapting Success: Business Strategies Amid the Pandemic

The COVID-19 pandemic has forced businesses to reevaluate and adapt their strategies to navigate through unprecedented challenges. This article explores various business strategies implemented by organizations to thrive and succeed in the midst of the pandemic.

Business Strategies Pandemic: A Comprehensive Guide

For a comprehensive guide on business strategies during the pandemic, visit Business Strategies Pandemic for valuable insights and resources.

Digital Transformation and E-Commerce Expansion:

The pandemic accelerated the need for businesses to embrace digital transformation. This paragraph delves into how companies swiftly adopted e-commerce solutions, online platforms, and digital tools to maintain operations, reach customers, and adapt to the changing landscape of consumer behavior.

Agile and Flexible Business Models:

Adaptability became a key factor in business survival. This section explores how businesses adopted agile and flexible business models, allowing them to quickly respond to changing market conditions, supply chain disruptions, and evolving customer demands.

Remote Work and Virtual Collaboration:

The widespread shift to remote work transformed the traditional workplace. This paragraph discusses how businesses implemented remote work strategies and leveraged virtual collaboration tools to ensure continuity, employee safety, and productivity in the face of lockdowns and social distancing measures.

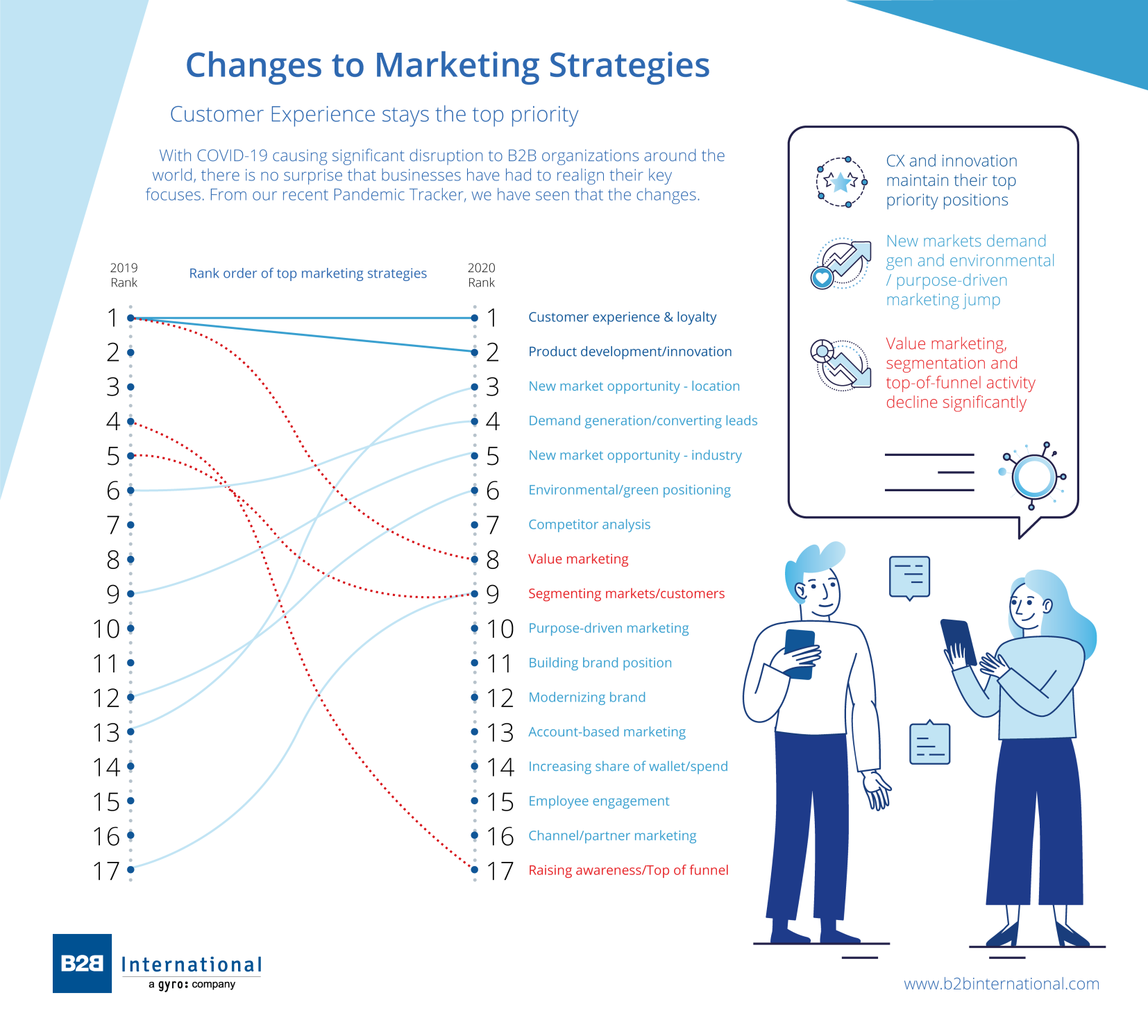

Customer-Centric Approaches and Personalization:

Understanding the shifting priorities and needs of customers became paramount. This section explores how businesses adopted customer-centric approaches, personalized services, and enhanced communication to strengthen customer relationships and loyalty during uncertain times.

Supply Chain Diversification and Resilience:

Global supply chain disruptions highlighted the importance of resilience. This paragraph examines how businesses diversified their supply chains, embraced local sourcing, and implemented measures to enhance resilience against external shocks, ensuring a more robust and adaptable supply network.

Cost-Cutting and Operational Efficiency:

Facing economic uncertainties, businesses focused on cost-cutting and operational efficiency. This section explores strategies such as streamlining processes, renegotiating contracts, and optimizing resource utilization to ensure financial stability and weather the financial challenges of the pandemic.

Innovation and Product Development:

Innovation emerged as a driving force for businesses seeking growth. This paragraph discusses how companies invested in research and development, introduced new products or services, and adapted existing offerings to meet the changing needs of the market and consumers.

Community Engagement and Corporate Social Responsibility:

Maintaining a strong connection with the community became a priority. This section explores how businesses engaged in corporate social responsibility initiatives, supported local communities, and demonstrated a commitment to social causes, enhancing their brand reputation and fostering a positive public image.

Strategic Partnerships and Collaborations:

Amid uncertainty, strategic partnerships and collaborations became a strategy for mutual benefit. This paragraph examines how businesses formed alliances, entered into collaborations, and leveraged shared resources to navigate challenges collectively, enhancing their capabilities and market presence.

Financial Planning and Risk Management:

Sound financial planning and risk management became critical for business survival. This section explores how businesses reassessed their financial strategies, built contingency plans, and managed risks effectively to withstand economic uncertainties and unforeseen disruptions.

Conclusion:

Adapting success in the midst of a pandemic requires businesses to be agile, innovative, and customer-centric. Whether through digital transformation, flexible business models, remote work strategies, or community engagement, organizations have demonstrated resilience and creativity in navigating challenges. As the business landscape continues to evolve, the lessons learned from the pandemic will shape the strategies and approaches that businesses adopt in the post-pandemic era.

Business Resilience: Strategic Adaptations in Pandemic Era

Introduction

The global pandemic has reshaped the business landscape, necessitating strategic adaptations for survival and growth. This article explores the innovative and resilient business strategies that have emerged in response to the challenges posed by the pandemic, highlighting the agility and creativity demonstrated by businesses in navigating these unprecedented times.

Agile Business Models

In the face of uncertainty, businesses have embraced agile models that prioritize flexibility and adaptability. Agile business strategies allow companies to pivot swiftly in response to changing market conditions. This approach has proven crucial in navigating disruptions and identifying new opportunities amid the evolving business environment.

Digital Transformation Acceleration

The pandemic accelerated the pace of digital transformation across industries. Businesses rapidly adopted and expanded digital technologies to facilitate remote work, enhance customer experiences, and streamline operations. This shift has not only improved efficiency but has also positioned companies to thrive in the digital age by embracing e-commerce, virtual collaboration, and data-driven decision-making.

Diversification of Revenue Streams

Recognizing the vulnerability of relying on a single revenue stream, many businesses diversified their income sources. Companies explored new product lines, entered untapped markets, or enhanced existing offerings to cater to changing consumer needs. Diversification has become a strategic imperative for building resilience against economic uncertainties.

Emphasis on E-commerce and Online Presence

With lockdowns and social distancing measures in place, businesses placed a heightened emphasis on bolstering their e-commerce capabilities and online presence. Establishing a robust online platform became not only a means of survival but also a way to reach a broader audience and adapt to shifting consumer behaviors.

Supply Chain Resilience

The pandemic exposed vulnerabilities in global supply chains, prompting businesses to reassess and fortify their supply chain resilience. Companies have focused on building more transparent, flexible, and localized supply networks to mitigate disruptions and ensure a steady flow of goods and services.

Focus on Employee Well-being and Remote Work Policies

Recognizing the importance of a healthy and engaged workforce, businesses implemented strategies to prioritize employee well-being. Remote work policies, flexible scheduling, mental health support, and initiatives to foster a positive work culture became integral to sustaining a motivated and productive team in the remote work era.

Innovation and Productivity Enhancements

The need to adapt to the “new normal” prompted businesses to innovate and enhance productivity. Companies invested in technologies that facilitate collaboration, automation, and innovation. This strategic focus on productivity improvements not only ensures operational efficiency but also positions businesses for sustained growth in dynamic markets.

Community Engagement and Social Responsibility

Businesses have increasingly recognized the importance of community engagement and social responsibility. Initiatives supporting local communities, environmental sustainability, and social causes have become integral parts of corporate strategies. These efforts not only contribute to the greater good but also resonate positively with consumers.

Financial Planning and Risk Management

The pandemic underscored the significance of robust financial planning and risk management. Businesses that weathered the storm effectively had proactive financial strategies in place, including contingency planning, cost control measures, and scenario analysis. This strategic financial resilience positioned them to navigate uncertainties and seize opportunities.

Conclusion with Link

In conclusion, the dynamic and challenging business environment brought about by the pandemic has catalyzed transformative strategies. For further insights into navigating the evolving business landscape and implementing effective strategies, visit The Healthy Consumer website. Explore resources for business resilience and stay informed about the latest strategies shaping the future of business.

Navigating the Global Economic Pandemic: Strategies for Resilience

Navigating the Global Economic Pandemic: Strategies for Resilience

The world has been thrust into unprecedented challenges with the onset of the Global Economic Pandemic. As nations grapple with economic uncertainties, adopting robust strategies for resilience becomes imperative.

Understanding the Economic Impact

The Global Economic Pandemic has triggered disruptions across industries, leading to widespread job losses, financial instability, and a reevaluation of economic structures. Understanding the multifaceted impact is crucial for formulating effective responses.

Government Stimulus and Support

Governments worldwide have responded with stimulus packages and support measures to mitigate the economic fallout. These initiatives aim to provide financial assistance to businesses, individuals, and sectors heavily affected by the pandemic, injecting liquidity into strained economies.

Adapting Business Models

In the face of economic challenges, businesses are compelled to rethink and adapt their models. The shift to digital platforms, embracing e-commerce, and exploring innovative solutions have become essential strategies for surviving and thriving in the new economic landscape.

Investing in Digital Transformation

The Global Economic Pandemic has accelerated the need for digital transformation. Businesses that invest in technology to streamline processes, enhance online presence, and facilitate remote work are better positioned to navigate the challenges posed by the economic downturn.

Workforce Resilience and Upskilling

Maintaining a resilient workforce is paramount. Upskilling employees to meet the demands of evolving industries and fostering adaptability can enhance individual and collective resilience in the face of economic uncertainties.

Sustainable Practices for Long-Term Growth

Amidst economic challenges, there is a growing recognition of the importance of sustainable practices. Businesses that prioritize environmental, social, and governance (ESG) factors are not only contributing to a better world but are also building a foundation for long-term economic growth.

Global Economic Collaboration

The interconnected nature of the global economy calls for increased collaboration among nations. Coordinated efforts to address trade imbalances, promote economic cooperation, and share resources are essential for a collective recovery from the Global Economic Pandemic.

Financial Planning and Risk Management

Individuals and businesses alike are placing a renewed emphasis on financial planning and risk management. Diversifying investments, creating emergency funds, and implementing robust risk mitigation strategies are critical in navigating economic uncertainties.

Reshaping Economic Policies

The Global Economic Pandemic necessitates a reevaluation of economic policies. Governments are challenged to develop policies that promote inclusive growth, address income inequality, and build economic resilience in the face of future crises.

Community and Global Solidarity

In times of economic hardship, fostering community and global solidarity is crucial. Collaborative initiatives, support networks, and a shared commitment to overcoming economic challenges contribute to building a more resilient and interconnected world.

The Path Forward – Global Economic Pandemic

In the journey to navigate the complexities of the Global Economic Pandemic, The Healthy Consumer serves as a valuable resource. Explore comprehensive information, stay informed, and actively participate in collective efforts to foster economic resilience. Together, we can build a stronger, more sustainable global economy.

Navigating Pandemic Challenges: Essential Response Tips

Strategies for Navigating Pandemic Challenges: Essential Response Tips

The ongoing pandemic has thrust individuals and communities into unprecedented circumstances, demanding thoughtful and effective responses. In this article, we explore key tips for navigating the challenges presented by the pandemic and maintaining resilience.

Staying Informed: The Cornerstone of Effective Response

In the face of rapidly evolving circumstances, staying informed is crucial. Regularly check reliable sources for updates on the pandemic’s status, health guidelines, and government recommendations. An informed approach forms the basis for making sound decisions and taking proactive measures to protect oneself and others.

Prioritizing Personal Health: A Foundation for Resilience

One of the most fundamental response tips is to prioritize personal health. This includes adhering to recommended hygiene practices, maintaining a nutritious diet, staying physically active, and getting sufficient sleep. Strengthening individual health is a proactive measure that contributes to overall resilience in the face of the pandemic.

Adapting to Remote Work: Navigating the New Normal

For those whose work allows it, adapting to remote work has become a significant aspect of pandemic response. Establishing a dedicated workspace, maintaining a routine, and utilizing collaboration tools effectively are key elements for a successful transition to remote work. Balancing professional and personal life becomes essential in this new normal.

Embracing Technology for Connection: Overcoming Social Distancing

While physical distancing is crucial for public health, maintaining social connections is equally important. Embrace technology to stay connected with friends, family, and colleagues. Virtual gatherings, video calls, and online activities can help alleviate feelings of isolation and foster a sense of community during these challenging times.

Financial Planning and Budgeting: Building Financial Resilience

The economic impact of the pandemic underscores the importance of financial planning. Assess your financial situation, create a budget, and prioritize essential expenses. Building financial resilience involves exploring opportunities for saving, identifying potential sources of support, and adapting spending habits to navigate economic uncertainties.

Caring for Mental Well-being: Seeking Support and Coping Strategies

The pandemic has brought about heightened stress and anxiety. Prioritize mental well-being by seeking support when needed. This may involve talking to friends, family, or mental health professionals. Additionally, incorporate stress-reducing activities into your routine, such as mindfulness, exercise, or hobbies.

Community Engagement: Supporting and Being Supported

Communities play a crucial role in pandemic response. Look for opportunities to support local businesses, volunteer, or contribute to community initiatives. Engaging with your community fosters a sense of solidarity and provides mutual support during challenging times.

Flexible Planning for the Future: Anticipating and Adapting

Pandemic response involves flexible planning for an uncertain future. Anticipate potential challenges, but remain adaptable. Set realistic goals, reassess plans regularly, and be open to adjusting strategies based on evolving circumstances. Flexibility is a key attribute in navigating the dynamic nature of the pandemic.

Educational and Skill Development: Investing in Personal Growth

Use the time during the pandemic as an opportunity for personal growth and skill development. Online courses, virtual workshops, and self-directed learning can enhance your knowledge and skills. Investing in education not only contributes to personal development but also positions you for future opportunities.

Accessing Pandemic Response Tips: A Comprehensive Resource

For additional insights and resources on navigating the challenges of the pandemic, consider exploring Pandemic Response Tips. This centralized hub offers a wealth of information, practical tips, and support to help individuals and communities navigate the complexities of the ongoing pandemic with resilience and determination.